A student bank account is a current account designed for those heading off to further education. Find out about additional benefits and apply for a student bank account.

- To apply, you must be 17+ and have been living in the UK for at least 3 years. Online applications only.

- You need to be a full time undergraduate student (on at least a 2-year course at a UK University/College) or you need to be completing a full time postgraduate or nursing course lasting a year or more. You can apply within 6 months of your course start date.

- You must use your Student account as your main account by depositing your wages or other regular income into it.

- If you have received a student offer from NatWest at any time from 1st July 2020 you will not be eligible. NatWest have the right to withdraw this offer at any time.

Award-winning

This account packs a punch, that's why it's award winning.

YourMoney.com voted NatWest as 'Best everyday current account provider', plus this current account was given 5 stars by the Defaqto experts in 2024.

Student Bank Account | Student Accounts UK | NatWest

Apply for a NatWest Student bank account and receive a free 4 year tastecard worth £29.99 per year*

*Annual tastecard value excluding any offers. Correct as at 2nd October 2023.

tastecard

What is a tastecard?

Tastecard is a discount card which offers you 2 for 1 on meals, 50% off food or 25% off food and drinks at thousands of restaurants or pizza takeaways UK wide.

We also have exclusive offers just for students.

- Cinema ticket discounts

- Discounted days out at the UK's best attractions

- Exclusive membership perks

We’ll send your tastecard redemption code to your email address.

Offer T&Cs apply. This offer can be withdrawn at any time. Valid for 4 years. Smartphone required.

Debit card

Brand-new plastic

Shop online or pay in-store with a new student debit card.

Contactless

Shop, tap and go

Tap-and-bleep your debit card to check out up to £100 in shops, restaurants, and more.

Apple or Google Pay

Banking for any device

Paying for items on your iPhone or Android is simple. You can use it to pay for things online or in-store with a tap. Criteria and retailer limits apply.

Direct Debit

Bills, bills, bills

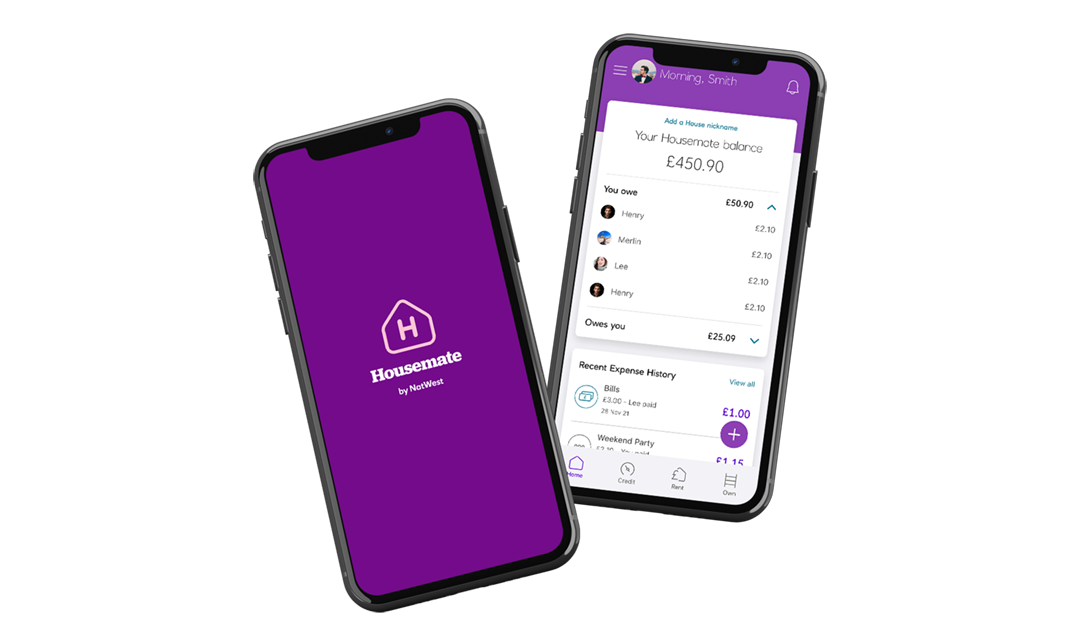

Got a regular bill that needs paid via Direct Debit? You can set that up on a NatWest Student account. Or if you need to split your household bills, check out our Housemate app.

Make use of a student overdraft

Our Student bank account comes with an interest-free overdraft. A quarter of students budget and monitor their spending. But around one in three are still short of money by the end of the month, says our annual Student living index.

That's when your overdraft may come in handy as a short-term option. And because it’s interest-free, you won’t pay any interest on what you’ve spent.

Interest-free overdraft - get an overdraft of up to £2,000 from year one (Limited to £500 in term one, year one) with an instant online decision. Students can apply for up to £3,250 interest-free from year three onwards.

To apply for an overdraft, you need to be:aged 18+. You can add an overdraft to your account once your course has started.

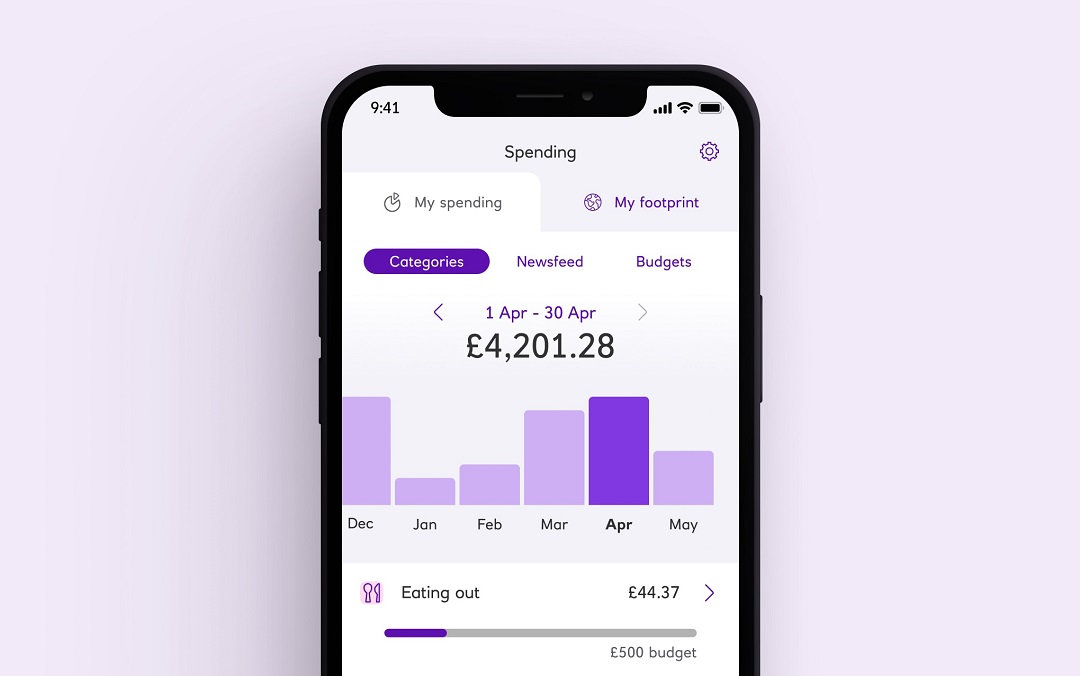

Manage your Student account with our app

See how much you have in your Student current account and transfer money between accounts from your smartphone. Students save on average £109 per month, according to our Student Living Index 2023. Easily move money into your savings account with our app.

App available to customers aged 11+ with compatible iOS and Android devices and a UK or international mobile number in specific countries.

Be bill savvy with Housemate

Want to take the hassle out of house sharing? With Housemate by NatWest, you can split household bills and pay each other back. You could also build your history with our partner Experian when you register your rent payments with the app. It’s free and you don’t have to bank with NatWest to use it.

Housemate is a free app open to users aged 17+ across the UK (excluding the Channel Islands and Northern Ireland). Users must have a UK bank account and an iOS or Android compatible device. Open Banking is available for selected UK banks and account types only. You need to be registered for your own bank’s online banking. The rent recognition feature is only open to those residing in England or Wales.

Student FAQs

Switch to NatWest

The Current Account Switch Service will do all the work when it comes to switching, moving everything across from your old account to your new account all within 7 working days, including Direct Debits and standing orders. All you need to do is tell us the details of your old bank account and when you want the Switch to start.

We can not switch savings accounts or ISAs through this service. Any other products you have with your old bank will not be moved at the same time.

Current Account Switch Guarantee (PDF, 39KB)

If you carry on applying, it means you're happy with what's in these documents, including the FSCS information sheet. And happy to view your statements in Online Banking - not posted. Please take some time to review, print and/or save the important information.