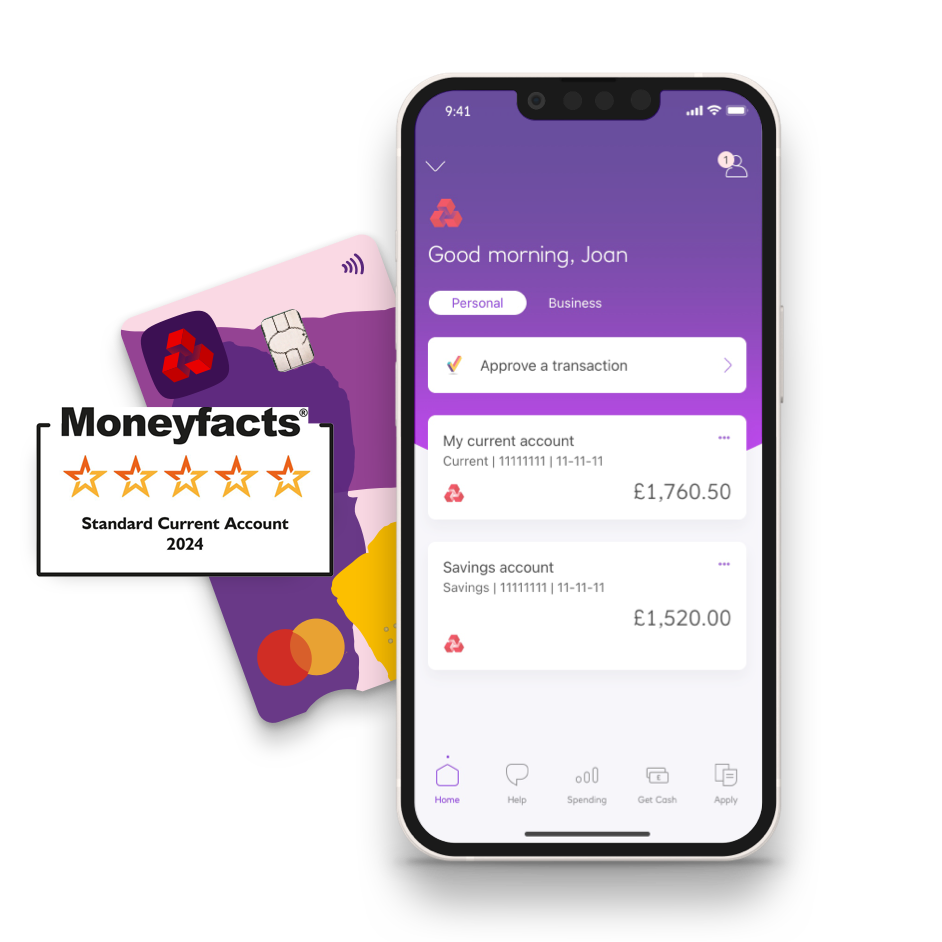

Award-winning

This account packs a punch, that's why it's award winning.

YourMoney.com voted NatWest as 'Best everyday current account provider', plus this current account was given 5 stars by the Defaqto experts in 2024.

Everyday banking with NatWest

On-the-go money management

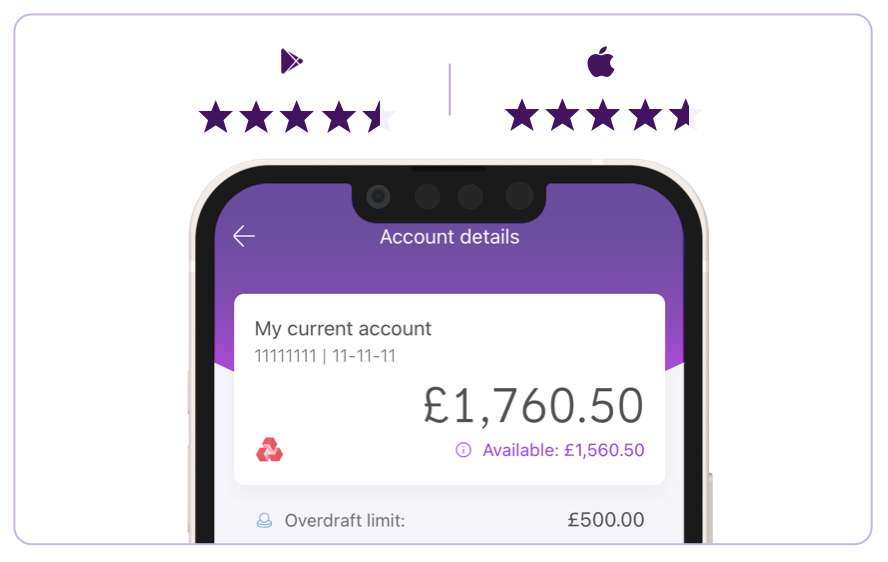

Seamlessly manage your money with our app.

- Easily check your balance as soon as you log in.

- Transfer money quickly between your NatWest accounts

- Cardless cash withdrawals from our ATMs. Criteria applies.

- Create, change, or cancel Direct Debits and standing orders.

And many more powerful tools to make your everyday easy (criteria may apply).

App Store and Google Play Store™ ratings correct as of 26th of May 2022.

Switch to NatWest

The Current Account Switch Service will do all the work when it comes to switching, moving everything across from your old account to your new account all within 7 working days, including Direct Debits and standing orders. All you need to do is tell us the details of your old bank account and when you want the Switch to start.

We can not switch savings accounts or ISAs through this service. Any other products you have with your old bank will not be moved at the same time.

Current Account Switch Guarantee (PDF, 39KB)

Basic bank account - FAQs

If you carry on applying, it means you're happy with what's in these documents, including the FSCS information sheet. And happy to view your statements in Online Banking - not posted. Please take some time to review, print and/or save the important information.