The value of investments can fall as well as rise, and you may not get back the full amount you invest. Eligibility criteria, fees and charges apply.

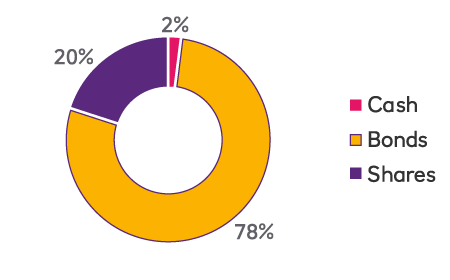

Personal Portfolio Defensive Fund

Low risk fund

This is the lowest risk fund in the range with an emphasis towards low risk assets, such as bonds. The low risk fund invests at least 70% of its value in bonds.

The long term asset mix is made up of 78% bonds, 20% shares and 2% cash.

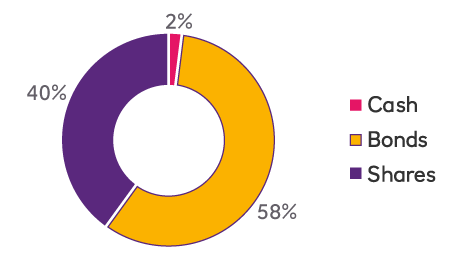

Personal Portfolio Cautious Fund

Low to medium risk fund

As the risk increases, the amount invested in lower risk investments, such as bonds reduces. The low to medium risk fund invests at least 50% of its value in bonds.

The long term asset mix is made up of 58% bonds, 40% shares and 2% cash.

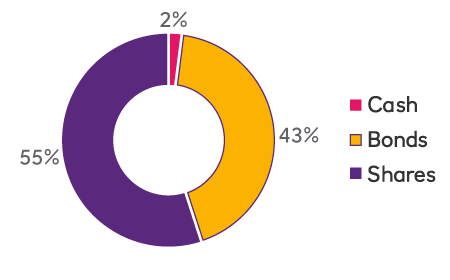

Personal Portfolio Balanced Fund

Medium risk fund

The medium risk fund has an increasing exposure to higher risk investments, such as shares. The medium risk fund invests at least 45% of its value in shares.

The long term asset mix is made up of 43% bonds, 55% shares and 2% cash.

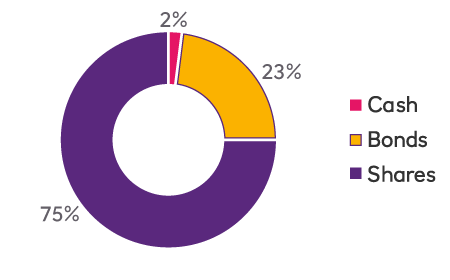

Personal Portfolio Ambitious Fund

Medium to high risk fund

As risk increases further, so does the exposure to shares. The medium to high risk fund invests at least 65% of its value in shares.

The long term asset mix is made up of 23% bonds, 75% shares and 2% cash.

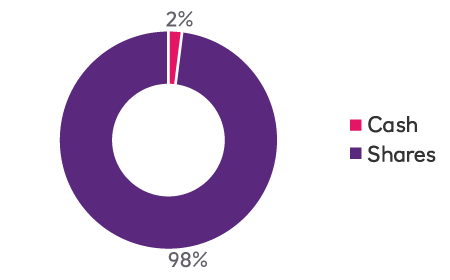

Personal Portfolio Adventurous Fund

High risk fund

This is the highest risk fund in the range with the greatest emphasis on higher risk assets, such as shares. The high risk fund invests at least 90% of its value in shares. As the risk profile increases to a high level, so does the feasibility of a large return or a larger capital loss.

The long term asset mix is made up of 98% shares and 2% cash.

Our funds' asset mix allocation may vary but will always be consistent with their objective.

Each illustration shows long term asset mix, effective from November 2022.