On this page

What you need to open a bank account

Want a NatWest bank account?

If you’re looking to open a NatWest bank account, you’ll need a few things first. Our guide covers the document types we’re likely to ask for and where you can find them.

We offer a range of bank accounts, with different features that may fit your needs. For most of our current accounts, you need to be aged 18+ and a UK resident. There are a few exceptions. Some of our accounts have extra eligibility criteria required to apply. If applicable, you can find these on the webpage for the account you're interested in. If you aren't a resident in the UK you won't be able to open a bank account with NatWest.

What do I need to open a bank account in the UK?

When you're applying for a bank account in the UK, you'll usually be asked to prove your identity and address. There are different types of documents that different banks accept for you to prove where you live and who you are. Are you new to the UK?

Proof of ID

Identification is needed to prove you are who you say you are. This can include:

- Your passport

- A full or provisional UK driving licence (you can often use this to prove both your identity and address)

- An EU ID card.

Proof of address

Your bank will need to check your address, so they know where to send statements and any other info. Proof of address can include:

- A recent utility bill

- A recent bank statement

- Tax documents

- A full or provisional UK driving licence.

Why do banks ask for proof of ID and address?

- We work hard to prevent money laundering. This is when criminals try to disguise money that has been made illegally to use it for their own benefit.

- Criminals often attempt to open a bank account using fake or stolen ID. We try to stop this by verifying all our new customers with proof of identity and often their current address.

- If you’re applying online, we try to complete this electronically using our security partners DigiDocs or Mitek so please have your ID to hand before you begin your application.

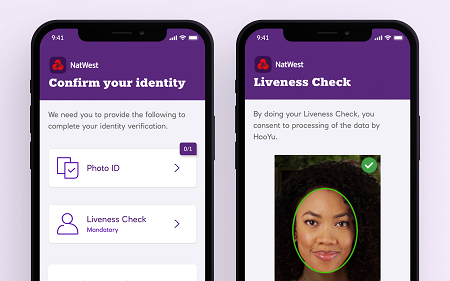

How can you prove your identity online?

We want to get your account up and running as soon as possible so we’ll ask you to upload some documents. To do this you’ll need access to a device that has a camera.

This helps us check you are who you say you are.

We'll ask for:

Photo ID, such as: driving licence, passport or EU ID card

A selfie to compare with your photo ID

We might also need to see a proof of address, such as: a driving licence, utility bill, bank statement or tax document.

Please make sure the documents you use exactly match the information you enter in your application.

If you don't have your documents with you, you can select to do this later. Once you've finished your application look out for an email and text from us and our security partners, Mitek or DigiDocs.

If you're under 18, we may need some additional information. Please refer to 'What ID do I need if I'm under 18?' for guidance.

If you’re under 18, we’ll ask for the following to prove your identity online:

- Photo ID - this must be either a Passport, EU/EEA ID card, PASS card or a UK Provisional Driving Licence

- A liveness check, a selfie to compare to your photo ID.

Also, if you are:

Aged 11-15, you’ll need your parent/guardians support and they’ll need to bank with NatWest.

Aged 16-17 and aren't able to prove your identity and address with your own documents, you'll need to apply with your parent/guardian who has a NatWest current account.

If your surname isn’t the same as your parent/guardians, you’ll need to provide a proof of relationship document to show the link between you both (and if required, name change documents).

Documents we can accept

The quickest way to get a NatWest account is to apply online, but if you haven’t got the online ID documents ready then you can bring them in to one of our branches or send via post.

You’ll need one document to confirm your identity and one document as proof of address.

You can use your full or provisional driving licence as proof of both your identity and address proof of both your identity and address.

Documents we can accept in branch and by post:

Proof of identity we accept for adults in branch

To be accepted, the following criteria must be met:

Be the original document

Match the exact name used when applying

Match the exact date of birth used when applying

Be valid / in date

Must have at least 6 months left to run on Visa (if Visa is required) for all non-EU applicants presenting a foreign passport

EU nationals include Switzerland, Norway, Iceland, Lichtenstein, Romania and Bulgaria.

To be accepted, the following criteria must be met:

Be photographic and clearly state the country of issue

Match the exact name used when applying

Match the exact date of birth used when applying

Be valid / in date

Please note, from 1st April 2019 we no longer accept Romanian ID cards.

To be accepted, the following criteria must be met:

Issued by DWP. Scottish public pensions agency, local authority, UC welcome letter, pensions benefits, housing benefits, child benefits, disability and sickness benefits

Specific to the individual about benefits currently being received

Must Include either NI number or DOB

Must confirm the customer is currently in receipt of benefit

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

Can only be used as proof of identity or proof of address. Not both.

A benefits letter that is addressed to a carer but is for the person opening the account can also be used but only as a last resort. The applicants name must be mentioned in the letter and the carer must reside at the same address as the applicant.

To be accepted, the following criteria must be met:

The documents we can accept are:

A notice of tax coding or

A National Insurance Confirmation letter.

The document must:

Specific to the individual

Must include either NI number or date of birth

Match the exact name and address used when applying

Be issued in the last 12 months.

Can only be used as proof of identity or proof of address. Not both.

Visit the UK government website if you'd like more information on obtaining a HMRC document.

To be accepted, the following criteria must be met:

An immigration and National Directorate (IND) Registration Card:

Must match the exact name used when applying

Must match all other personal details used when applying

Only be provided if applicant is unemployed.

A travel document issued by the Government of the UK and Northern Ireland:

Must match the exact name used when applying

Must match all other personal details used when applying

Be issued in the UK prior to 31 Dec 2004, if presented with a Grant of Status Letter or Entry Clearance Visa providing indefinite right to remain.

Still be in date, and have more than 3 months left to run.

To be accepted, the following criteria must be met:

Be a full or provisional photocard licence (the paper counterpart is no longer valid as legal ID), issued in the UK

Match the date of birth used when applying

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

If the address on your UK Full or Provisional Driving Licence matches your application, you can use this one document for both proof of identity and proof of address.

To be accepted, the following criteria must be met:

Be a full photocard licence (the paper counterpart is no longer valid as legal ID), issued in EU member countries, or in Iceland, Norway, Switzerland or Liechtenstein

Match the date of birth used when applying

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

Can only be used as proof of identity or proof of address. Not both.

To be accepted, the following criteria must be met:

Match the exact name used when applying

Match the exact address used when applying

Match the exact date of birth used when applying

Be valid / in date.

To be accepted, the following criteria must be met:

Must match the exact name used when applying

Must match the date of birth used when applying

Be valid/in date

The card must contain your staff serial number.

Proof of identity we accept for adults by post

To be accepted, the following criteria must be met:

Issued by DWP. Scottish public pensions agency, local authority, UC welcome letter, pensions benefits, housing benefits, child benefits, disability and sickness benefits.

Specific to the individual about benefits currently being received

Must Include either NI number or DOB

Must confirm the customer is currently in receipt of benefit.

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

Can only be used as proof of identity or proof of address. Not both.

A benefits letter that is addressed to a carer but is for the person opening the account can also be used but only as a last resort. The applicants name must be mentioned in the letter and the carer must reside at the same address as the applicant.

To be accepted, the following criteria must be met:

The documents we can accept are:

A notice of tax coding or

A National Insurance Confirmation letter.

The document must:

Specific to the individual

Must include either NI number or date of birth

Match the exact name and address used when applying

Be issued in the last 12 months.

Can only be used as proof of identity or proof of address. Not both.

Visit the UK government website if you'd like more information on obtaining a HMRC document.

To be accepted, the following criteria must be met:

An immigration and National Directorate (IND) Registration Card:

Must match the exact name used when applying

Must match all other personal details used when applying

Only be provided if applicant is unemployed.

A travel document issued by the Government of the UK and Northern Ireland:

Must match the exact name used when applying

Must match all other personal details used when applying

Be issued in the UK prior to 31 Dec 2004, if presented with a Grant of Status Letter or Entry Clearance Visa providing indefinite right to remain

Still be in date, and have more than 3 months left to run.

Proof of identity we accept for students in branch

Along with proof of ID, we also need you to provide proof of your student status.

To be accepted, the following criteria must be met:

Be the original document

Match the exact name used when applying

Match the exact date of birth used when applying

Be valid / in date

Must have at least 6 months left to run on Visa (if Visa is required) for all non-EU applicants presenting a foreign passport

EU nationals include Switzerland, Norway, Iceland, Lichtenstein, Romania and Bulgaria.

To be accepted, the following criteria must be met:

Be photographic and clearly state the country of issue

Match the exact name used when applying

Match the exact date of birth used when applying

Be valid / in date.

Please note, from 1st April 2019 we no longer accept Romanian ID cards.

To be accepted, the following criteria must be met:

Be for a customer who is:

- 20 years old and under with no other form of ID

- Have special circumstances e.g. (Applicants in care homes, sheltered accommodation, permanent care, children's homes, in care and living at home).

Must exactly match the name used when applying

Must exactly match the date of birth used when applying

Be a Full or Abbreviated Birth Certificate or a Certified Copy of an Entry from the General Registry Office (England and Wales) or an Extract of an Entry in the Register of Births (Scotland).

To be accepted, the following criteria must be met:

Be a full or provisional photocard licence (the paper counterpart is no longer valid as legal ID), issued in the UK

Match the date of birth used when applying

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

If the address on your UK Full or Provisional Driving Licence matches your application, you can use this one document for both proof of identity and proof of address.

To be accepted, the following criteria must be met:

Be a full photocard licence (the paper counterpart is no longer valid as legal ID), issued in EU member countries, or in Iceland, Norway, Switzerland or Liechtenstein

Match the date of birth used when applying

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

Can only be used as proof of identity or proof of address. Not both.

To be accepted, the following criteria must be met:

The documents we can accept are:

A notice of tax coding or

A National Insurance Confirmation letter.

The document must:

Be specific to the individual

Include either NI number or date of birth

Match the exact name and address used when applying

Be issued in the last 6 months or for the current tax year

Can only be used as proof of identity or proof of address. Not both.

Visit the UK government website if you'd like more information on obtaining a HMRC document.

Proof of identity we accept for students by post

Along with proof of ID, we also need you to provide proof of your student status.

To be accepted, the following criteria must be met:

Be for a customer who is:

- 20 years old and under with no other form of ID

- Have special circumstances e.g. (Applicants in care homes, sheltered accommodation, permanent care, children's homes, in care and living at home)

Must exactly match the name used when applying

Must exactly match the date of birth used when applying

Be a Full or Abbreviated Birth Certificate or a Certified Copy of an Entry from the General Registry Office (England and Wales) or an Extract of an Entry in the Register of Births (Scotland).

To be accepted, the following criteria must be met:

The documents we can accept are:

A notice of tax coding or

National Insurance Confirmation letter.

The document must:

Be specific to the individual

Include either NI number or date of birth

Match the exact name and address used when applying

Be issued in the last 6 months or for the current tax year

Can only be used as proof of identity or proof of address. Not both.

Visit the UK government website if you'd like more information on obtaining a HMRC document.

Proof of identity we accept for under 18s in branch

Please note, if you’re applying for an account with your parent/guardians support and your surnames aren’t the same, you must provide a proof of relationship document to show the link between you both (and if required, name change documents). See the below section 'Proof of relationship' for further information.

ID options:

To be accepted, the following criteria must be met:

Be the original document

Match the exact name used when applying

Match the exact date of birth used when applying

Be valid / in date

Must have at least 6 months left to run on Visa (if Visa is required) for all non-EU applicants presenting a foreign passport

EU nationals include Switzerland, Norway, Iceland, Lichtenstein, Romania and Bulgaria.

To be accepted, the following criteria must be met:

Be photographic and clearly state the country of issue

Match the exact name used when applying

Match the exact date of birth used when applying

Be valid / in date.

Please note, from 1st April 2019 we no longer accept Romanian ID cards.

To be accepted, the following criteria must be met:

Be for a customer who is:

- 20 years old and under with no other form of ID

- Have special circumstances e.g. (Applicants in care homes, sheltered accommodation, permanent care, children's homes, in care and living at home)

Must exactly match the name used when applying

Must exactly match the date of birth used when applying

Be a Full or Abbreviated Birth Certificate or a Certified Copy of an Entry from the General Registry Office (England and Wales) or an Extract of an Entry in the Register of Births (Scotland).

To be accepted, the following criteria must be met:

Be for an existing pupil of the school providing the letter

Be addressed to the Bank

Be on headed paper or stamped by the school

Match the name on the application exactly

Match the date of birth on the application and be for a customer who is 18 years old or under

Match the address the application

Be issued by a known school.

Please note that one letter is sufficient to cover both proof of identity and proof of address for the same application.

To be accepted, the following criteria must be met:

Be a full or provisional photocard licence (the paper counterpart is no longer valid as legal ID), issued in the UK

Match the date of birth used when applying

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

If the address on your UK Full or Provisional Driving Licence matches your application, you can use this one document for both proof of identity and proof of address.

To be accepted, the following criteria must be met:

Be a full photocard licence (the paper counterpart is no longer valid as legal ID), issued in EU member countries, or in Iceland, Norway, Switzerland or Liechtenstein

Match the date of birth used when applying

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

Can only be used as proof of identity or proof of address. Not both.

To be accepted, this document must:

The documents we can accept are:

- A notice of tax coding or

- A National Insurance Confirmation letter.

The document must:

Be specific to the individual

Include either NI number or date of birth

Match the exact name and address used when applying

Be issued in the last 6 months or for the current tax year

Can only be used as proof of identity or proof of address. Not both.

Visit the UK government website if you'd like more information on obtaining a HMRC document.

To be accepted, this document must:

Be for a customer who is aged 20 years or younger

Match the exact name used when applying

Match the exact date of birth used when applying

Be valid / in date.

If the surname of the adult and child doesn't match, you must provide documentation to show the link between the applicant child and parent/guardian.

The following documents can be accepted as proof of relationship:

- Birth/Adoption Certificate.

- Legal guardianship.

- HMRC/Benefits letter.

- Child arrangement order.

- Foster agreement.

Proof of identity we accept for under 18s by post

Please note, if you’re applying for an account with your parent/guardians support and your surnames aren’t the same, you must provide a proof of relationship document to show the link between you both (and if required, name change documents). See the below section 'Proof of relationship' for further information.

ID options:

To be accepted, the following criteria must be met:

Be for a customer who is:

- 20 years old and under with no other form of ID

- Have special circumstances e.g. (Applicants in care homes, sheltered accommodation, permanent care, children's homes, in care and living at home)

Must exactly match the name used when applying

Must exactly match the date of birth used when applying

Be a Full or Abbreviated Birth Certificate or a Certified Copy of an Entry from the General Registry Office (England and Wales) or an Extract of an Entry in the Register of Births (Scotland).

To be accepted, the following criteria must be met:

Be for an existing pupil of the school providing the letter

Be addressed to the Bank

Be on headed paper or stamped by the school

Match the name on the application exactly

Match the date of birth on the application and be for a customer who is 18 years old or under

Match the address the application

Be issued by a known school.

Please note that one letter is sufficient to cover both proof of identity and proof of address for the same application.

To be accepted, this document must:

The documents we can accept are:

A notice of tax coding or

A National Insurance Confirmation letter.

The document must:

Be specific to the individual

Include either NI number or date of birth

Match the exact name and address used when applying

Be issued in the last 6 months or for the current tax year

Can only be used as proof of identity or proof of address. Not both.

Visit the UK government website if you'd like more information on obtaining a HMRC document.

If the surname of the adult and child doesn't match, you must provide documentation to show the link between the applicant child and the parent/guardian.

The following documents can be accepted as proof of relationship:

- Birth/Adoption Certificate.

- Legal guardianship.

- HMRC/Benefits letter.

- Child arrangement order.

- Foster agreement.

Proof of address we accept for adults in branch

For your Driving licence to be accepted, the following criteria must be met:

Be a full or provisional photocard licence (the paper counterpart is no longer valid as legal ID), issued in the UK

Match the date of birth used when applying

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

If the address on your UK Full or Provisional Driving Licence matches your application, you can use this one document for both proof of identity and proof of address.

For your Driving licence to be accepted, the following criteria must be met:

Be a full photocard licence (the paper counterpart is no longer valid as legal ID), issued in EU member countries, or in Iceland, Norway, Switzerland or Liechtenstein

Match the date of birth used when applying

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

Can only be used as proof of identity or proof of address. Not both.

We can accept the following documents:

Council Tax bill, including reminders.

Council Tax adjustment notice letter.

Current council tax arrears letter.

Council tax letter for Direct Debits.

Council tax exemption letter.

Council Tax payment card accompanied by a letter issued by the council which confirms the council tax reference.

Council Tax benefit letter provided it has been sent to your current address and shows the Council Tax reference. This can be accepted to confirm either your identity or address. Not both.

The document must:

- Be less than 12 months old

- Be less than 12 months old

- Be for the property you reside at & match the exact address used when applying

- Have your name in the addressee part of the document

- The name must match the exact name provided when applying.

Where an e-statement/e-bill or PDF of your Council tax is used this can only be used where one of the following has been used as identification.

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA National Identity Card.

Military ID Card.

If you have not used one of the above as your identification, you cannot use an e-statement/ e-bill or PDF of your Council Tax as address verification.

To be accepted, the following criteria must be met:

The original, sent to your current home address

An online PDF statement.

A Post Office statement.

All must:

Be less than 6 months old

Match the exact address used when applying

Match the exact name used when applying.

Where an e-statement/e-bill or PDF of your Bank/Building Society statement is used, this can only be used where one of the following has been used as identification:

UK Passport/Foreign Passport/Visa.

UK Driving Licence.

EU/EEA National Identity Card.

Military ID Card.

If you haven't used one of the above as your identification, you cannot use an e-statement/ e-bill or PDF of your Bank/ Building Society statement as address verification.

To be accepted, the following criteria must be met:

Issued by DWP. Scottish public pensions agency, local authority, UC welcome letter, pensions benefits, housing benefits, child benefits, disability and sickness benefits

Specific to the individual about benefits currently being received

Must Include either NI number or Date of birth

Must confirm the applicant is currently in receipt of benefit

Match the exact name and address used when applying

Be valid/in date.

Can only be used as proof of identity or proof of address. Not both.

A benefits letter that is addressed to a carer but is for the person opening the account can also be used but only as a last resort. The applicants name must be mentioned in the letter and the carer must reside at the same address as the applicant.

Where an e-statement/e-bill or PDF of your documentation from the Benefits Agency is used, this can only be used when one of the following has been used as identification:

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national identity Card.

Military ID Card.

If you haven't used one of the above as your identification you cannot use an e-statement/e-bill or PDF of your documentation from the Benefits Agency as address verification.

To be accepted, the following criteria must be met:

The name and address must match the application.

Please ensure the Credit Union appears as approved / authorised on the FCA search page (Opens in New Window).

To be accepted, the following criteria must be met:

The documents we can accept are:

A notice of tax coding or

A National Insurance Confirmation letter.

The document must:

Be specific to the individual

Include either NI number or date of birth

Match the exact name and address used when applying

Be issued in the last 12 months .

Can only be used as proof of identity or proof of address. Not both.

Where an e-statement/e-bill or PDF of your HMRC tax notifications & correspondence is used, this can only be used where one of the following has been used as identification:

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national identity Card.

Military ID Card.

If you have not used one of the above as your identification you cannot use an e-statement/ e-bill or PDF of your HMRC tax notifications and correspondence as address verification.

Visit the UK government website if you'd like more information on obtaining a HMRC document.

To be accepted, the following criteria must be met:

Be less than 6 months old

Match the exact name and address used when applying.

Be a:

- Utility bill.

- Utility statement.

- Reminder bill.

- A letter on headed paper from the utility company confirming direct debit payments.

- A Utility bill for internet services that confirms the price to be paid each month.

An e-statement/ e-bill or PDF of your Utility bill/ statement can only be used when one of the following has been used as identification:

UK Passport/Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national Identity Card.

Military ID Card.

If you haven't used one of the above as your identification, you cannot use an e-statement/e-bill or PDF of your Utility bill/ statement as address verification.

We cannot accept:

Mobile telephone bills.

TV licences.

A utility bill that is addressed to a different address to where the utility is being provided.

A delivery bill for oil, coal, logs.

To be accepted, this document must:

Be the original and less than 12 months old or

Be a PDF/e-bill/e-statement of your mortgage statement and be less than 12 months old

Match the exact name and address used when applying

The letter can be addressed to your previous address however the document must relate to the purchase of the property address which is used in your application.

Where an e-statement/e-bill or PDF of your mortgage statement is used this can only be used where one of the following has been used as identification:

UK Passport/Foreign Passport/Visa.

UK Driving Licence.

EU/EEA National Identity ID Card.

Military ID Card.

If you haven't used one of the above as your identification, you cannot use an e-statement/ e-bill or PDF of your mortgage statement as address verification

To be accepted, this document must either:

Be a current local council tenancy agreement.

Be a Housing association tenancy agreement.

Be a valid temporary tenancy agreement.

All documents must:

Be issued by a recognised local authority, or from a well known housing association

Be on headed paper and bear the stamp of the relevant council/housing association

Match the exact name and address used in the application.

Proof of address we accept for adults by post

We can accept the following documents:

Council Tax bill, including reminders.

Council Tax adjustment notice letter.

Current council tax arrears letter.

Council tax letter for Direct Debits.

Council tax exemption letter.

Council Tax payment card accompanied by a letter issued by the council which confirms the council tax reference.

Council Tax benefit letter provided it has been sent to your current address and shows the Council Tax reference. This can be accepted to confirm either your identity or address. Not both.

All must:

- Be less than 12 months old

- Be for the property you reside at & match the exact address used when applying

- Have your name in the addressee part of the document

- The name must match the exact name provided when applying.

Where an e-statement/e-bill or PDF of your Council tax is used this can only be used where one of the following has been used as identification.

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA National Identity Card.

Military ID Card.

If you have not used one of the above as your identification, you cannot use an e-statement/ e-bill or PDF of your Council Tax as address verification.

To be accepted, the following criteria must be met:

The original, sent to your current home address.

An online PDF statement.

A Post Office statement.

All must:

Be less than 6 months old

Match the exact address used when applying

Match the exact name used when applying.

Where an e-statement/e-bill or PDF of your Bank/Building Society statement is used, this can only be used where one of the following has been used as identification:

UK Passport/Foreign Passport/Visa.

UK Driving Licence.

EU/EEA National Identity Card.

Military ID Card.

If you haven't used one of the above as your identification, you cannot use an e-statement/ e-bill or PDF of your Bank/ Building Society statement as address verification.

To be accepted, the following criteria must be met:

Issued by DWP. Scottish public pensions agency, local authority, UC welcome letter, pensions benefits, housing benefits, child benefits, disability and sickness benefits

Specific to the individual about benefits currently being received

Must Include either NI number or Date of birth

Must confirm the applicant is currently in receipt of benefit

Match the exact name and address used when applying

Be valid/in date.

Can only be used as proof of identity or proof of address. Not both.

A benefits letter that is addressed to a carer but is for the person opening the account can also be used but only as a last resort. The applicants name must be mentioned in the letter and the carer must reside at the same address as the applicant.

Where an e-statement/e-bill or PDF of your documentation from the Benefits Agency is used, this can only be used when one of the following has been used as identification:

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national identity Card.

Military ID Card.

If you haven't used one of the above as your identification you cannot use an e-statement/e-bill or PDF of your documentation from the Benefits Agency as address verification.

To be accepted, the following criteria must be met:

The name and address must match the application.

Please ensure the Credit Union appears as approved / authorised on the FCA search page (Opens in New Window).

To be accepted, the following criteria must be met:

The documents we can accept are:

A notice of tax coding or

A National Insurance Confirmation letter.

The document must:

Specific to the individual

Must include either NI number or date of birth

Match the exact name and address used when applying

Be issued in the last 12 months.

Can only be used as proof of identity or proof of address. Not both.

Where an e-statement/e-bill or PDF of your HMRC tax notifications & correspondence is used, this can only be used where one of the following has been used as identification:

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national identity Card.

Military ID Card.

If you have not used one of the above as your identification you cannot use an e-statement/ e-bill or PDF of your HMRC tax notifications and correspondence as address verification.

Visit the UK government website if you'd like more information on obtaining a HMRC document.

To be accepted, the following criteria must be met:

Be less than 6 months old

Match the exact name and address used when applying.

Be a:

- Utility bill.

- Utility statement.

- Reminder bill.

- A letter on headed paper from the utility company confirming direct debit payments.

- A Utility bill for internet services that confirms the price to be paid each month.

An e-statement/ e-bill or PDF of your Utility bill/ statement can only be used when one of the following has been used as identification:

UK Passport/Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national Identity Card.

Military ID Card.

If you haven't used one of the above as your identification, you cannot use an e-statement/e-bill or PDF of your Utility bill/ statement as address verification.

We cannot accept:

Mobile telephone bills.

TV licences.

A utility bill that is addressed to a different address to where the utility is being provided.

A delivery bill for oil, coal, logs.

To be accepted, this document must:

Be the original and less than 12 months old or

Be a PDF/e-bill/e-statement of your mortgage statement and be less than 12 months old

Match the exact name and address used when applying

The letter can be addressed to your previous address however the document must relate to the purchase of the property address which is used in your application.

Where an e-statement/e-bill or PDF of your mortgage statement is used this can only be used where one of the following has been used as identification:

UK Passport/Foreign Passport/Visa.

UK Driving Licence

EU/EEA National Identity ID Card.

Military ID Card.

If you haven't used one of the above as your identification, you cannot use an e-statement/ e-bill or PDF of your mortgage statement as address verification.

To be accepted, this document must either:

Be a current local council tenancy agreement.

Be a Housing association tenancy agreement.

Be a valid temporary tenancy agreement.

All documents must:

Be issued by a recognised local authority, or from a well known housing association

Be on headed paper and bear the stamp of the relevant council/housing association

Match the exact name and address used in the application.

Proof of address we accept for students in branch

Along with proof of address, we also need you to provide proof of your student status.

For your Driving licence to be accepted, the following criteria must be met:

Be a full or provisional photocard licence (the paper counterpart is no longer valid as legal ID), issued in the UK

Match the date of birth used when applying

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

If the address on your UK Full or Provisional Driving Licence matches your application, you can use this one document for both proof of identity and proof of address.

For your Driving licence to be accepted, the following criteria must be met:

Be a full photocard licence (the paper counterpart is no longer valid as legal ID), issued in EU member countries, or in Iceland, Norway, Switzerland or Liechtenstein

Match the date of birth used when applying

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

Can only be used as proof of identity or proof of address. Not both.

We can accept the following documents:

Council Tax bill, including reminders.

Council Tax adjustment notice letter.

Current council tax arrears letter.

Council tax letter for Direct Debits.

Council tax exemption letter.

Council Tax payment card accompanied by a letter issued by the council which confirms the council tax reference.

Council Tax benefit letter provided it has been sent to your current address and shows the Council Tax reference. This can be accepted to confirm either your identity or address. Not both.

The document must:

- Be less than 12 months old

- Be for the property you reside at & match the exact address used when applying

- Have your name in the addressee part of the document

- The name must match the exact name provided when applying.

Where an e-statement/e-bill or PDF of your Council tax is used this can only be used where one of the following has been used as identification.

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA National Identity Card.

Military ID Card.

If you have not used one of the above as your identification, you cannot use an e-statement/ e-bill or PDF of your Council Tax as address verification.

To be accepted, the document must either be:

The original, sent to your current home address.

An online PDF statement.

A Post Office statement.

All must:

Be less than 6 months old

Match the exact address used when applying

Match the exact name used when applying.

Where an e-statement/e-bill or PDF of your Bank/Building Society statement is used, this can only be used where one of the following has been used as identification:

UK Passport/Foreign Passport/Visa.

UK Driving Licence.

EU/EEA National Identity Card.

Military ID Card.

If you haven't used one of the above as your identification, you cannot use an e-statement/ e-bill or PDF of your Bank/ Building Society statement as address verification.

To be accepted, the following criteria must be met:

Issued by DWP, Scottish public pensions agency, local authority, UC welcome letter, pensions benefits, housing benefits, child benefits, disability and sickness benefits

Specific to the individual about benefits currently being received

Must Include either NI number or Date of birth

Must confirm the applicant is currently in receipt of benefit

Match the exact name and address used when applying

Be valid/in date.

Can only be used as proof of identity or proof of address. Not both.

A benefits letter that is addressed to a carer but is for the person opening the account can also be used but only as a last resort. The applicants name must be mentioned in the letter and the carer must reside at the same address as the applicant.

Where an e-statement/e-bill or PDF of your documentation from the Benefits Agency is used, this can only be used when one of the following has been used as identification:

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national identity Card.

Military ID Card.

If you haven't used one of the above as your identification you cannot use an e-statement/e-bill or PDF of your documentation from the Benefits Agency as address verification.

The simplest way to prove your student status is to enter your UCAS Status Code into the application form. (This is a 16-digit code emailed to you by UCAS. If you have misplaced this email please contact UCAS who will reissue within 24 hours)

Other documents we can accept are:

UCAS/NMAS Letter:

The letter must be on headed paper

It must include the UCAS/NMAS application number and match the address on the application form

Must match the address used when applying.

Student Loan Company/LEA/SAAS Award Letter:

The award letter must match the address on the application form

Be on headed paper.

University/College Letter of Acceptance/Enrolment Offer/Enrolment Certificate:

Letters should be on headed paper and addressed to the Bank or to you at your application address.

It can be an original letter, an email or an internet print.

The letter must confirm you are onto the course and match the address on the application form.

It must be issued by a Government/LEA/SAAS funded University/College.

If issued by anyone else this is not acceptable.

Letters from a language schools are not acceptable.

The course must still have six months left to run for the letter to be accepted unless it’s an English course.

Where an English course is less than six months, confirmation of both courses is required and the total length must be more than six months.

To be accepted, the following criteria must be met:

The documents we can accept are:

A notice of tax coding or

A National Insurance Confirmation letter.

The document must:

Be specific to the individual

Include either NI number or date of birth

Match the exact name and address used when applying

Be issued in the last 6 months or for the current tax year

Can only be used as proof of identity or proof of address. Not both.

Where an e-statement/e-bill or PDF of your HMRC tax notifications & correspondence is used, this can only be used where one of the following has been used as identification:

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national identity Card.

Military ID Card.

If you have not used one of the above as your identification you cannot use an e-statement/ e-bill or PDF of your HMRC tax notifications and correspondence as address verification.

Visit the UK government website if you'd like more information on obtaining a HMRC document.

To be accepted, the following criteria must be met:

Be less than 6 months old

Match the exact name and address used when applying.

Be a:

- Utility bill.

- Utility statement.

- Reminder bill.

- A letter on headed paper from the utility company confirming direct debit payments.

- A Utility bill for internet services that confirms the price to be paid each month.

An e-statement/ e-bill or PDF of your Utility bill/ statement can only be used when one of the following has been used as identification:

UK Passport/Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national Identity Card.

Military ID Card.

If you haven't used one of the above as your identification, you cannot use an e-statement/e-bill or PDF of your Utility bill/ statement as address verification.

We cannot accept:

Mobile telephone bills.

TV licences.

A utility bill that is addressed to a different address to where the utility is being provided.

A delivery bill for oil, coal, logs.

To be accepted, this document must either:

Be a current local council tenancy agreement.

Be a Housing association tenancy agreement.

Be a valid temporary tenancy agreement.

All documents must:

Be issued by a recognised local authority, or from a well known housing association

Be on headed paper and bear the stamp of the relevant council/housing association

Match the exact name and address used in the application.

Proof of address we accept for students by post

Along with proof of address, we also need you to provide proof of your student status.

We can accept the following documents:

Council Tax bill, including reminders.

Council Tax adjustment notice letter.

Current council tax arrears letter.

Council tax letter for Direct Debits.

Council tax exemption letter.

Council Tax payment card accompanied by a letter issued by the council which confirms the council tax reference.

Council Tax benefit letter provided it has been sent to your current address and shows the Council Tax reference. This can be accepted to confirm either your identity or address. Not both.

The document must:

- Be less than 12 months old

- Be for the property you reside at & match the exact address used when applying

- Have your name in the addressee part of the document

- The name must match the exact name provided when applying.

Where an e-statement/e-bill or PDF of your Council tax is used this can only be used where one of the following has been used as identification

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA National Identity Card.

Military ID Card.

If you have not used one of the above as your identification, you cannot use an e-statement/ e-bill or PDF of your Council Tax as address verification.

To be accepted, the document must either be:

The original, sent to your current home address.

An online PDF statement.

A Post Office statement.

All must:

Be less than 6 months old

Match the exact address used when applying

Match the exact name used when applying.

Where an e-statement/e-bill or PDF of your Bank/Building Society statement is used, this can only be used where one of the following has been used as identification:

UK Passport/Foreign Passport/Visa.

UK Driving Licence.

EU/EEA National Identity Card.

Military ID Card.

If you haven't used one of the above as your identification, you cannot use an e-statement/ e-bill or PDF of your Bank/ Building Society statement as address verification.

To be accepted, the following criteria must be met:

Issued by DWP. Scottish public pensions agency, local authority, UC welcome letter, pensions benefits, housing benefits, child benefits, disability and sickness benefits

Specific to the individual about benefits currently being received

Must Include either NI number or Date of birth

Must confirm the applicant is currently in receipt of benefit

Match the exact name and address used when applying

Be valid/in date.

Can only be used as proof of identity or proof of address. Not both.

A benefits letter that is addressed to a carer but is for the person opening the account can also be used but only as a last resort. The applicants name must be mentioned in the letter and the carer must reside at the same address as the applicant.

Where an e-statement/e-bill or PDF of your documentation from the Benefits Agency is used, this can only be used when one of the following has been used as identification:

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national identity Card.

Military ID Card.

If you haven't used one of the above as your identification you cannot use an e-statement/e-bill or PDF of your documentation from the Benefits Agency as address verification.

The simplest way to prove your student status is to enter your UCAS Status Code into the application form. (This is a 16 digit code emailed to you by UCAS. If you have misplaced this email please contact UCAS who will reissue within 24 hours)

Other documents we can accept are:

UCAS/NMAS Letter:

The letter must be on headed paper

It must include the UCAS/NMAS application number and match the address on the application form

Must match the address used when applying.

Student Loan Company/LEA/SAAS Award Letter:

The award letter must match the address on the application form

Be on headed paper.

University/College Letter of Acceptance/Enrolment Offer/Enrolment Certificate:

Letters should be on headed paper and addressed to the Bank or to you at your application address.

It can be an original letter, an email or an internet print.

The letter must confirm you are onto the course and match the address on the application form.

It must be issued by a Government/LEA/SAAS funded University/College.

If issued by anyone else this is not acceptable.

Letters from language schools are not acceptable.

The course must still have six months left to run for the letter to be accepted unless it’s an English course.

Where an English course is less than six months, confirmation of both courses is required and the total length must be more than six months.

To be accepted, the following criteria must be met:

The documents we can accept are:

A notice of tax coding or

A National Insurance Confirmation letter.

The document must:

Be specific to the individual

Include either NI number or date of birth

Match the exact name and address used when applying

Be issued in the last 6 months or for the current tax year

Can only be used as proof of identity or proof of address. Not both.

Where an e-statement/e-bill or PDF of your HMRC tax notifications & correspondence is used, this can only be used where one of the following has been used as identification:

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national identity Card.

Military ID Card.

If you have not used one of the above as your identification you cannot use an e-statement/ e-bill or PDF of your HMRC tax notifications and correspondence as address verification.

Visit the UK government website if you'd like more information on obtaining a HMRC document.

To be accepted, the following criteria must be met:

Be less than 6 months old

Match the exact name and address used when applying.

Be a:

- Utility bill.

- Utility statement.

- Reminder bill.

- A letter on headed paper from the utility company confirming direct debit payments.

- A Utility bill for internet services that confirms the price to be paid each month.

An e-statement/ e-bill or PDF of your Utility bill/ statement can only be used when one of the following has been used as identification:

UK Passport/Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national Identity Card.

Military ID Card.

If you haven't used one of the above as your identification, you cannot use an e-statement/e-bill or PDF of your Utility bill/ statement as address verification.

We cannot accept:

Mobile telephone bills.

TV licences.

A utility bill that is addressed to a different address to where the utility is being provided.

A delivery bill for oil, coal, logs.

To be accepted, this document must either:

Be a current local council tenancy agreement.

Be a Housing association tenancy agreement.

Be a valid temporary tenancy agreement.

All documents must:

Be issued by a recognised local authority, or from a well known housing association

Be on headed paper and bear the stamp of the relevant council/housing association

Match the exact name and address used in the application.

Proof of address we accept for under 18s in branch

Please note, if you’re applying for an account with your parent/guardians support and your surnames aren’t the same, you must provide a proof of relationship document to show the link between you both (and if required, name change documents). See the below section 'Proof of relationship' for further information.

Proof of address options:

For your Driving licence to be accepted, the following criteria must be met:

Be a full or provisional photocard licence (the paper counterpart is no longer valid as legal ID), issued in the UK

Match the date of birth used when applying

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

If the address on your UK Full or Provisional Driving Licence matches your application, you can use this one document for both proof of identity and proof of address.

For your Driving licence to be accepted, the following criteria must be met:

Be a full photocard licence (the paper counterpart is no longer valid as legal ID), issued in EU member countries, or in Iceland, Norway, Switzerland or Liechtenstein

Match the date of birth used when applying

Match the exact name used when applying

Match the exact address used when applying

Be valid/in date.

Can only be used as proof of identity or proof of address. Not both.

To be accepted, the document must either be:

The original, sent to your current home address.

An online PDF statement.

A Post Office statement.

All must:

Be less than 6 months old

Match the exact address used when applying

Match the exact name used when applying.

Where an e-statement/e-bill or PDF of your Bank/Building Society Statement is used, this can only be used where one of the following has been used as identification:

UK Passport/Foreign Passport/Visa.

UK Driving Licence.

EU/EEA National Identity Card.

Military ID Card.

If you haven't used one of the above as your identification, you cannot use an e-statement/ e-bill or PDF of your Bank/ Building Society statement as address verification.

To be accepted, the document must:

Be addressed to the bank

Match the exact name on the application

Match the exact address on the application

Match the date of birth on the application and be for a customer who is aged 18 years old or under

Be confirmed as genuine.*

*This can be done by a social worker being in the branch, with staff identification that confirms they are from the council, or an independent call back needs to be made.

To be accepted, the following criteria must be met:

The documents we can accept are:

A notice of tax coding or

A National Insurance Confirmation letter.

The document must:

Be specific to the individual

Include either NI number or date of birth

Match the exact name and address used when applying

Be issued in the last 6 months or for the current tax year.

Can only be used as proof of identity or proof of address. Not both.

Where an e-statement/e-bill or PDF of your HMRC tax notifications & correspondence is used, this can only be used where one of the following has been used as identification:

UK Passport, Foreign Passport/Visa.

UK Driving Licence.

EU/EEA national identity Card.

Military ID Card.

If you have not used one of the above as your identification you cannot use an e-statement/ e-bill or PDF of your HMRC tax notifications and correspondence as address verification.

Visit the UK government website if you'd like more information on obtaining a HMRC document.

To be accepted, the document must:

- Be for an existing pupil of the school providing the letter

- Be addressed to the Bank

- Be on headed paper or stamped by the school

- Match the name on the application exactly

- Match the date of birth on the application and be for a customer who is 18 years old or under

- Match the address on the application

- Be issued by a known school.

Please note, one letter is sufficient to cover both proof of identity and proof of address for the same application.

If the surname of the adult and child doesn't match, you must provide documentation to show the link between the applicant child and the parent/guardian.

The following documents can be accepted as proof of relationship:

- Birth/Adoption Certificate.

- Legal guardianship.

- HMRC/Benefits letter.

- Child arrangement order.

- Foster agreement.

Proof of address we accept for under 18s by post

Please note, if you’re applying for an account with your parent/guardians support and your surnames aren’t the same, you must provide a proof of relationship document to show the link between you both (and if required, name change documents). See the below section 'Proof of relationship' for further information.

Proof of address options:

To be accepted, the document must either be:

The original, sent to your current home address.

An online PDF statement.

A Post Office statement.

All must:

Be less than 6 months old

Match the exact address used when applying

Match the exact name used when applying.

Where an e-statement/e-bill or PDF of your Bank/Building Society Statement is used, this can only be used where one of the following has been used as identification:

UK Passport/Foreign Passport/Visa.

UK Driving Licence.

EU/EEA National Identity Card.

Military ID Card.

If you haven't used one of the above as your identification, you cannot use an e-statement/ e-bill or PDF of your Bank/ Building Society statement as address verification.

To be accepted, the document must:

Be addressed to the Bank

Match the exact name on the application

Match the exact address on the application

Match the date of birth on the application and be for a customer who is aged 18 years old or under

Be confirmed as genuine.*

*This can be done by a social worker being in the branch, with staff identification that confirms they are from the council, or an independent call back needs to be made.

If the surname of the adult and child doesn't match, you must provide documentation to show the link between the applicant child and the parent/guardian.

The following documents can be accepted as proof of relationship:

- Birth/Adoption Certificate.

- Legal guardianship.

- HMRC/Benefits letter.

- Child arrangement order.

- Foster agreement.

To be accepted, the document must:

- Be for an existing pupil of the school providing the letter

- Be addressed to the Bank

- Be on headed paper or stamped by the school

- Match the name on the application exactly

- Match the date of birth on the application and be for a customer who is 18 years old or under

- Match the address on the application

- Be issued by a known school.

Please note, one letter is sufficient to cover both proof of identity and proof of address for the same application.

To be accepted, the document must:

Be for an existing pupil of the school providing the letter

Be addressed to the Bank on headed paper or stamped by the school

Match the name on the application exactly

Match the date of birth on the application/request and be for a customer who is 18 years old or under.

Match the address the application

Be issued by a known school.

Please note, one letter is sufficient to cover both proof of identity and proof of address for the same application.

Are you new to the UK?

If you're new to the UK or are arriving soon, you'll need to know your new UK address before applying, and enter this during your application. Once you've applied, we'll ask you for proof of identity and proof of UK address, which we'll need to verify before we open your account.

Working in the UK

You may find it easier to get one of the following proof of address documents and apply online.

- HMRC notification of National Insurance number.

- HMRC notification of tax coding.

- Visit the UK government website if you'd like more information on obtaining a HMRC document. Go to gov website

- Bank statement from an existing bank which is now addressed to your new UK address (this does not need to be from a UK bank).

International student

You may find it easier and quicker to obtain one of the following proof of address documents and apply online.

- HMRC notification of National Insurance number.

- HMRC notification of tax coding.

- Visit the UK government website below, if you'd like more information on obtaining a HMRC document. Go to gov website

- Bank statement from an existing bank which is now addressed to your new UK address (this does not need to be from a UK bank).

- If you have lived in the UK for more than 3 years, you'll be eligible to apply for our student account.

Asylum seeker

If you're an Asylum seeker and are looking to open an account with us, please visit your local branch so they can help you complete an application.

You can use your ARC (Application Registration Card) as proof of ID, so take this with you along with proof of address if you have this. Take a look at our list of acceptable documents to know what we can accept as proof of address.

Open a NatWest bank account online

If you've got your proof of identity and proof of address documents ready, you can apply for a bank account online today. Take a look at the accounts we offer:

Our everyday current account

Our Select account is a basic bank account that gives you everything you need for your day-to-day banking needs:

- No fee monthly banking.

- Take care of your bank account on the go with our mobile app and Online Banking. Criteria apply.

- Pay however you like with Apple pay, Google Pay™ and contactless . Limits apply.

To apply, you need to be 18+ and a UK resident.

Reward current account

With the Reward bank account, for a £2 fee you could:

- Earn up to £5 a month back in Rewards.

- Redeem your Rewards as cashback, gift-cards or e-codes with a range of retailers.

- Even donate your Rewards to charity if you like.

To apply, you need to be 18 or over and a UK resident. To hold this account, you need to pay £1,250 into an eligible NatWest account every month. To earn £5 rewards, you earn £4 a month back in rewards for 2 or more Direct Debits (at least £2 each) and an additional £1 a month back in rewards with 1 mobile app log in.

Student current account

Are you in further education? Our Student bank account could be right for you. You'll get:

- An account free from a monthly fee.

- A 4-year taste card that gets you 2 for 1 or 50% off food bills at restaurants across the UK.

- Lost your bank card? No worries. Simply freeze and then unfreeze once you find it.

T&C’s apply. Eligibility criteria apply.

Child and teen bank accounts

Bank accounts for those aged up to 17

Most of us learn about money from our parents. That’s why choosing a kid’s account is such a big deal.

T&C’s apply. Eligibility criteria apply.

Why bank with NatWest?

Here 24/7

You can talk to us wherever and whenever you choose using video banking. This 24/7 service can help you keep on top of your goals with a free financial health check.

Help with financial health

It’s also possible to access our digital financial health check. The process only takes a few minutes and can help get your finances back on track.

Security matters to us

Security is important to us. That’s why we give you the option of being able to lock and unlock your debit card. If you or the other joint account holder misplaces a card, you can easily keep your finances safe until you find it.

All on the app

This is all done via the NatWest mobile app. This tool is helpful to manage your joint account and stay in control of your finances on the go.

FAQs - What you need to open a bank account

Depending on whether you're under 18, a student or adult there will be a range of documents that can be accepted. You can find acceptable photo ID docments for NatWest here.

When opening an account at NatWest we can accept a range of photo ID and address documents, you can find our up to date document list here.

There are a range of proof of address documents NatWest can accept at account opening, you'll find the full list for:

- Online account opening here.

- Address documents acceptable either by post or in branch here.

There are a number of ways you can provide proof of your address, review our acceptable address documents here to see what works best for you.

Whether you're new to the UK or arriving soon, you can find the documents required to open your account here.

If you're unable to provide any of the acceptable documents please contact your local branch who can review your individual circumstances.