On this page:

Overlay

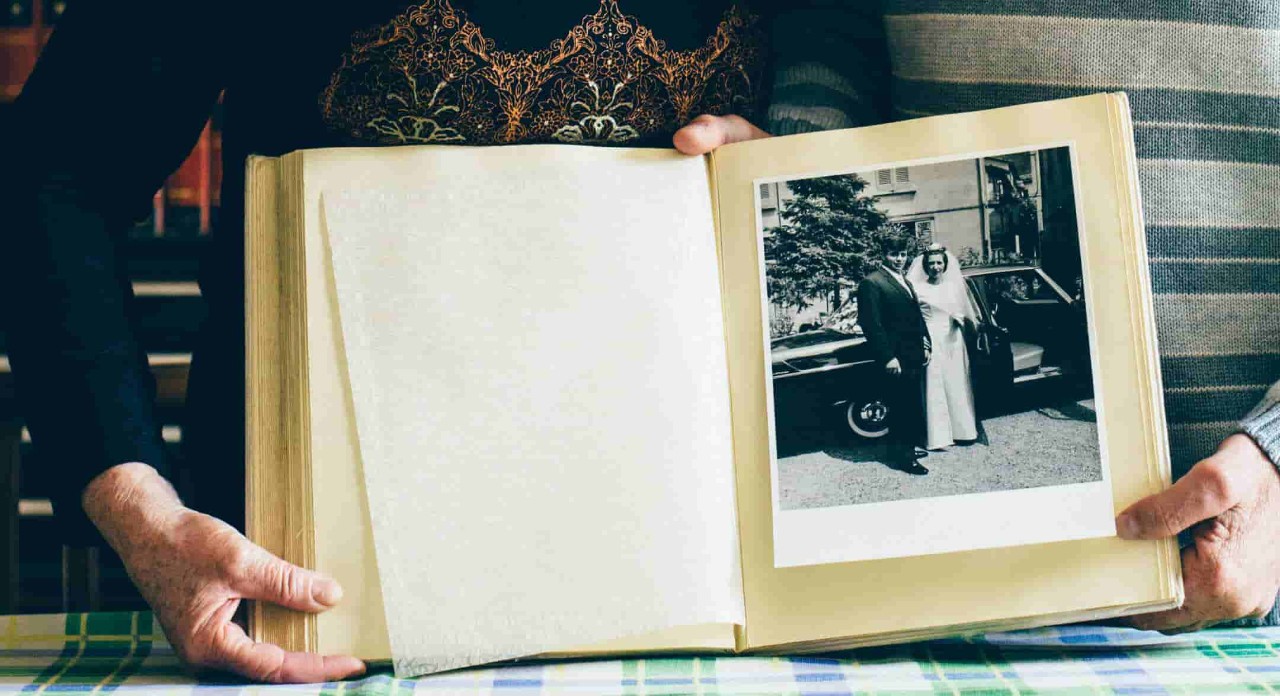

Helping you pass on your wealth

Knowing you have a will in place is reassuring for you and the ones you love. So whether it’s your first will, or you’re revising one you already have, now is the perfect time to ensure everything’s in place.

Considering making a will?

Making a will is the only way to ensure that your money and assets are shared according to your wishes. A fee will usually apply for this service.

Your first step is to speak to your Premier Manager. They know you and your financial objectives and so are ideally placed to discuss your will-writing needs.

Information Message

If you've previously used the will writing service provided by Hugh James Solicitors, please call them directly on 0330 024 2981.