On this page

NatWest mortgages are available to over 18s. Your home or property may be repossessed if you do not keep up repayments on your mortgage.

We surveyed 562 UK homeowners between 15th-21st May 2020

During these uncertain times, we want to help individuals and families find new ways to keep on top of their personal finances.

There are often misconceptions around what it means to remortgage and why a homeowner might want to do it. By asking homeowners to share their own personal stories of remortgaging, we hope to draw attention to the positive aspects of taking the time to review your mortgage deal.

We surveyed 562 UK homeowners between 15th-21st May who have remortgaged in the last 24 months, to find out about their experiences and how it impacted their finances.

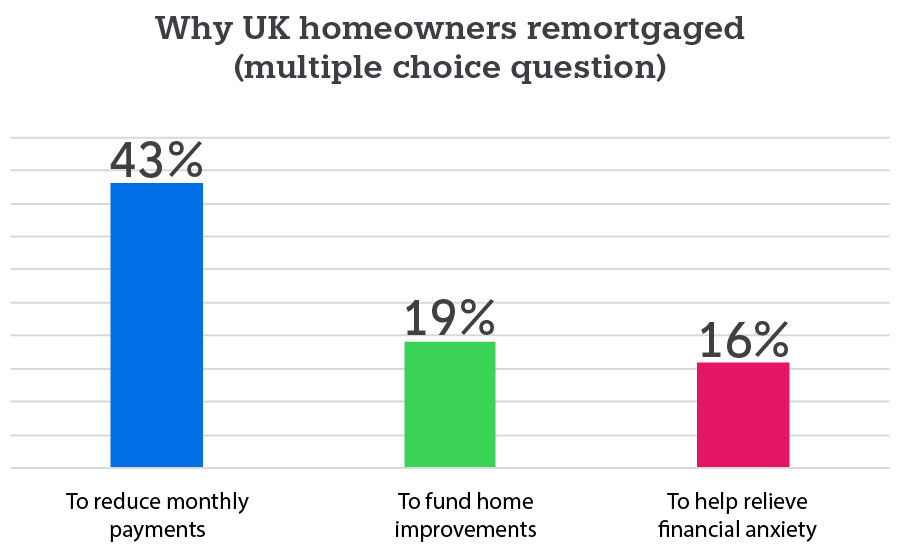

What are the top reasons for remortgaging?

- Reducing their monthly mortgage payments

- Funding home improvements

- Helping relieve financial anxiety on their households

What is remortgaging?

Remortgaging is the process of changing your mortgage deal and moving your mortgage to a new lender, often done to avoid moving onto your current lender’s Standard Variable Rate (SVR).

Your mortgage would normally move onto SVR when your deal ends after 2-5 years with your lender.

When you remortgage your home to a new lender, there is an opportunity to reduce your monthly payments, by paying less interest with a new initial mortgage rate.

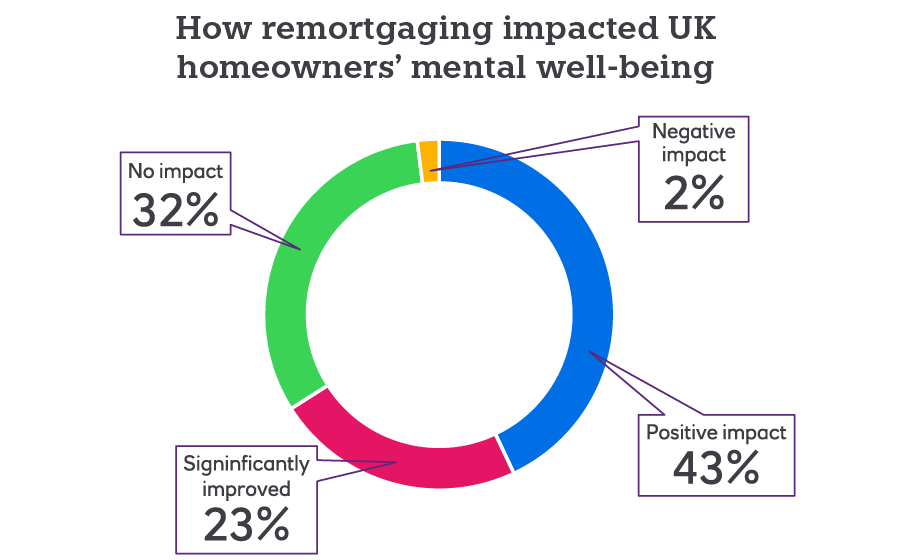

3 out of 4 homeowners surveyed say remortgaging has had a positive overall impact on their life

Reducing your monthly mortgage payments could provide you with more extra money in your household budget every month and more financial freedom.

From relieving financial pressures and supporting relatives, to remodelling homes and funding business ventures, we reveal home owners reasons to remortgage.

We found that the majority of people surveyed reduced their monthly payments by remortgaging

It's always a good idea to shop around and get the best price - so why wouldn't you do that with your mortgage? And, if you are no longer tied into a mortgage deal, then moving your mortgage might not cost you a penny.

As the Bank of England has recently set the base rate to an all-time low, now is a good time to search for a remortgage deal.

We found that 74% of participants reduced their monthly payments after remortgaging, whilst 38% have reduced their monthly payments by around 10% and 9% have saved up to 50% on their monthly payments.

Explore our mortgage types and see if you could be paying less each month too.

People are choosing to remortgage to help relieve financial anxieties caused by COVID-19

The coronavirus outbreak and lockdown measures introduced in the UK have deeply affected our personal lives. The pandemic has also impacted the nation’s economy, causing monetary stress in many households and businesses.

66% of respondents said that remortgaging had a positive impact or significantly improved their mental well-being

43% of people surveyed said that remortgaging had a positive impact on their mental health with a further 23% saying it significantly improved their mental well-being by reducing stress and increasing financial flexibility. Whilst 75% of those surveyed aged 18-30, list mental health as either the main or partial reason for their decision to remortgage.

Find out if you can remortgage to a better deal with us

74% UK homeowners surveyed said they pay less every month on their new mortgage deals. Remortgage with us and you could reduce your monthly mortgage payments too.

“It has given me more peace of mind financially and less uncertainty about the future has meant that I now feel less anxious” – [survey respondent]