This rate is available on loans between £7,500 and £14,950. Other loan amounts are available at alternative rates. Our rates depend on your circumstances, loan amount and term and may differ from the Representative APR.

To apply for a joint loan applicants must be 18+, a UK resident and either: both hold a sole NatWest current account (held for 3+months) or share a joint NatWest current account (held for 3+ months).

Get a quote with no credit score impact

If you both have a NatWest current account and you're looking for a joint loan, in most cases we’ll confirm the loan amount and rate at the start of your application with no impact on your credit score.

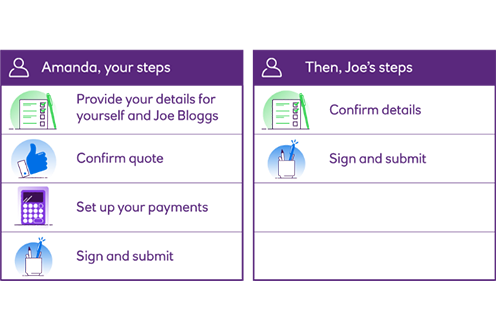

Apply in minutes

It can take as little as 10 minutes to apply for a NatWest joint loan online. We'll ask you to log in to Online Banking so have your details handy. We will also pre-fill some of your details to make the journey easier.

Money in your account the same day

You could get your joint loan funds on the same day if you apply online, are unconditionally accepted and both parties sign their loan documents before 5.45pm Mon – Fri.

If we need to contact you for some additional information, it can take a little longer.

Linking your finances

Taking on any new debt is a big decision, especially when you’re doing it as a team.

If you’re approved, your credit files will be linked and future lenders may take both your scores into account before approving you for any other borrowing.

It’s also key to know that if the person you’re taking a joint loan with defaults on a payment or the entire loan amount, you will be responsible for the full payment amount.

Borrowing terms

Joint loan calculator

Representative Example

£7,500

0 months

£137.55

£8,253.00

3.9

% APR

3.9

% p.a.

The rate you pay depends on your circumstances, loan amount and term and may differ from the Representative APR. We will never offer you a rate exceeding 29.9% p.a. (fixed), regardless of loan size. This means you're not guaranteed to get the rate you see in the calculator.

What does APR mean?

APR can be confusing. Grab a cuppa, take a few minutes and read our guide to APR for some help.

Can I pay off my loan early?

It’s important to remember that if you repay your loan early, you will be charged an Early Repayment Fee. The amount you will be charged will be equal to 58 days’ interest on the amount you repay early (28 days’ interest if the period of the Loan is one year or less). If there is less than 58 days (or 28 days if applicable) remaining on the loan, the calculation will be based on the actual number of days remaining. This is in addition to your outstanding loan amount and any outstanding interest.

Get a free personalised quote

If you both have a NatWest current account and you're looking for a joint loan, in most cases we’ll confirm the loan amount and rate at the start of your application with no impact on your credit score.

Sounds good so far? Just a bit more info to get through:

Joint mortgages

Interested in a shared mortgage? Find out more about joint mortgages. Criteria apply, over 18s.

Joint bank accounts

Needing a shared bank account? Find out more about joint bank accounts. Criteria apply.

Joint savings

Saving towards a joint goal? Find out more about joint savings accounts. Criteria apply.