On this page

Student loan options

First things first, let's cover what's available. As a student, you may be entitled to two loans – one for tuition fees and another for maintenance costs. And depending on where you live, there are a range of student finance bodies that could offer the relevant funding.

Scottish students attending Scottish universities do not pay tuition fees.

Tuition fee loan

Covering the costs of your course

The tuition fee loan is paid directly to your university. It covers course costs of up to £9,000 per year and isn’t dependent on your household income. If you’re going to a private university or college, the maximum loan available will be £6,000.

Maintenance loan

Covering the costs of living

The student maintenance loan is designed to cover living costs while you’re at university, including things like accommodation, food, transport and socialising. Your household income, where you study and where you live will all affect how much you’re entitled to.

How to apply for a student loan

We've outlined some key things to consider when applying for your student loan. For information on additional student finance options, check out the UCAS page on bursaries, grants and scholarships.

-

01

Get yourself organised

Make sure you apply in good time. Student loan applications can take up to six weeks to process, and if you don't apply early enough, your student loan should may not be paid into your account in time for the start of the course.

Student finance calculator

Use the Governent's student finance calculator to estimate how much student loan you could get or any extra student funding, for example if you’re disabled or have children.

-

02

Open a bank account

Be sure to have your bank account set up before you start the student loan application. Have all relevant details to hand when it comes to applying for a bank account, including ID and proof of student status.

-

03

Submit your application

For full details and to make the application, visit the relevant UK student finance body:

Student Awards Agency Scotland

Student Finance Northern Ireland

If you haven't applied for student finance before, you'll need to create an account. When it comes to making the application, it's important to have all required information to hand, including household income.

Still looking for a student bank account?

Apply today and you could get a £500 interest free student overdraft for term one year one, with the option to increase up to £2,000 term two year one. You can apply for up to £3,250 interest free from year three onwards*. You'll also get your hands on a contactless debit card.

*Eligible students in third year onwards can apply for up to £3,250 from 2nd October 2023.

Apply online only. You must be 17+ and have been living in the UK for at least 3 years. You must either be a full time undergraduate student on at least a 2 year course at a UK University/College or you must be completing a full time postgraduate or nursing course lasting a year or more. Student arranged overdrafts are available to NatWest Student current account customers, aged 18 or over. Subject to lending criteria.

How to budget at university

As a student, learning how to balance your finances is an important skill to master. Your student loan is paid to you in chunks at the start of each term, so you need to make sure that you spend wisely so each payment lasts you the full term.

Setting a student budget

Planning your budget isn’t always easy, but it’s an important part of student life. Seeing a big figure land in your Student account for the first time can be misleading.

Once you know how much you'll have to spend, you can start looking at what you need to spend it on. Try to work out what your expenditure will be over the same period – weekly or monthly. Our budget calculator is a great place to start. The trick is to make sure that your income is either more or the same as your expenditure. If expenditure is higher, you’re going to run out of money.

Helpful tips on budgeting

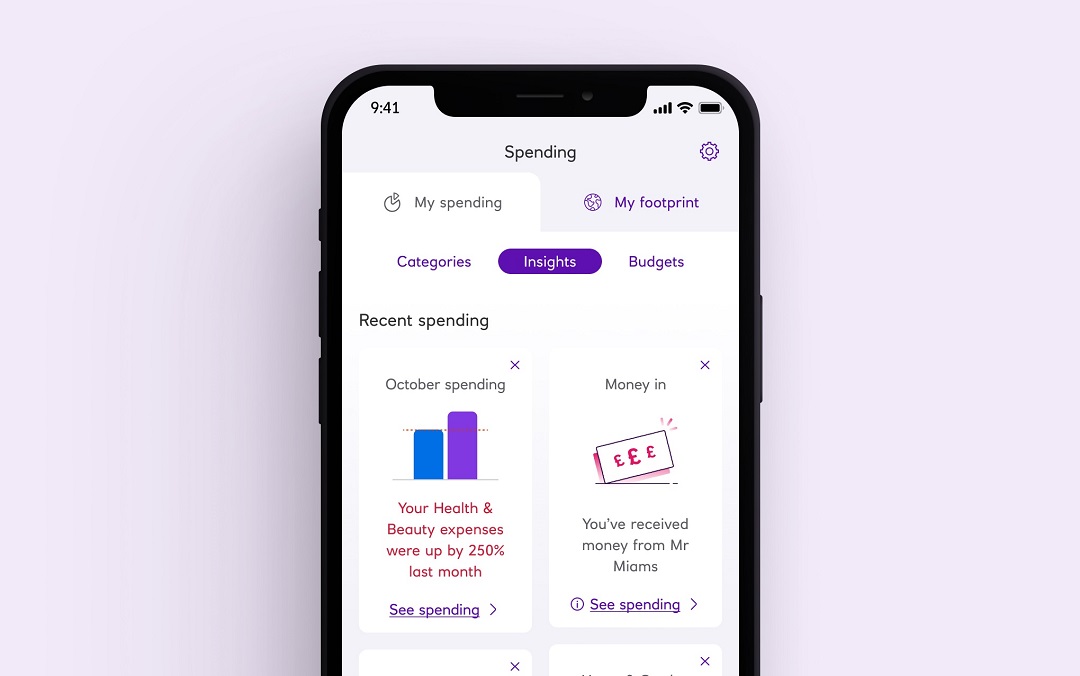

Download the app

Don't leave home without it. The mobile app is packed with features to help you stay on top of your student finances. The ability to check your balance, move money and handle your finances on the go.

- On your mobile or tablet, go to the App Store if using Apple or Google Play if using Android

- Search for 'NatWest Mobile Banking'

- Tap to download the app

App available to customers aged 11+ with compatible iOS and Android devices and a UK or international mobile number in specific countries.

Ready to pay off your student loan?

Check out our guide to paying back your student loan. We have the answers to some of the most common questions around when you start repaying your loan and how much.