Account Benefits

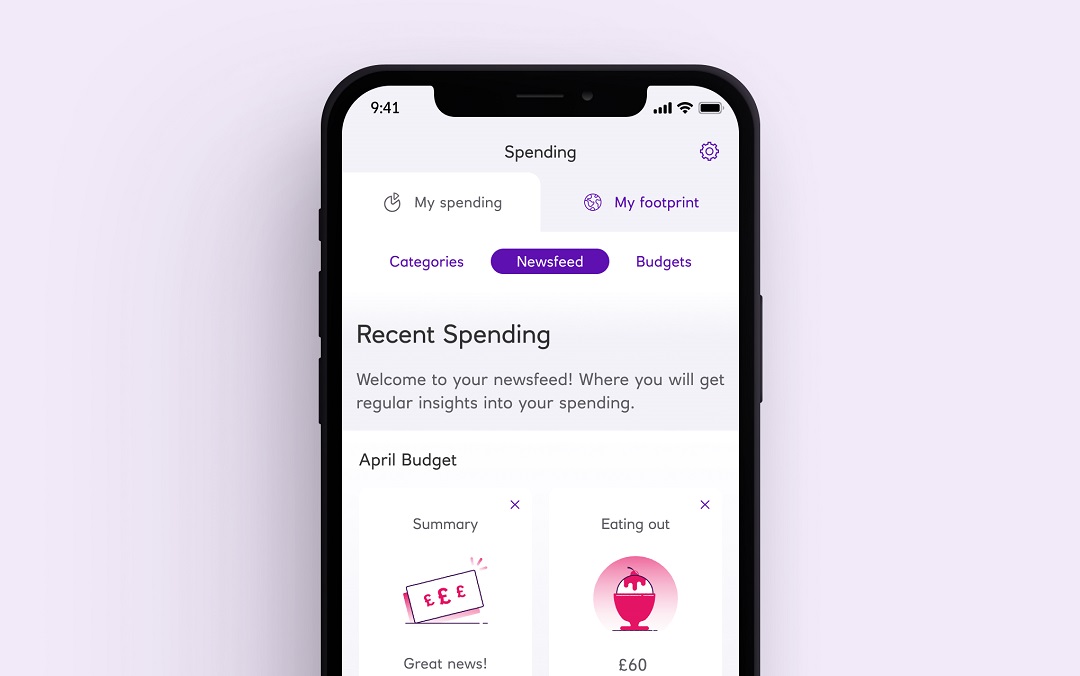

Keep track of spending

Ever got to the end of a month and wondered where your money went? Well wonder no more. Our expense tracker feature ‘Spending’ within the app tells you everything you need to know, from categorising your spend to surfacing personalised insights. You can even set budgets to help you track your spending. You can also get spending notifications every time you use your card.

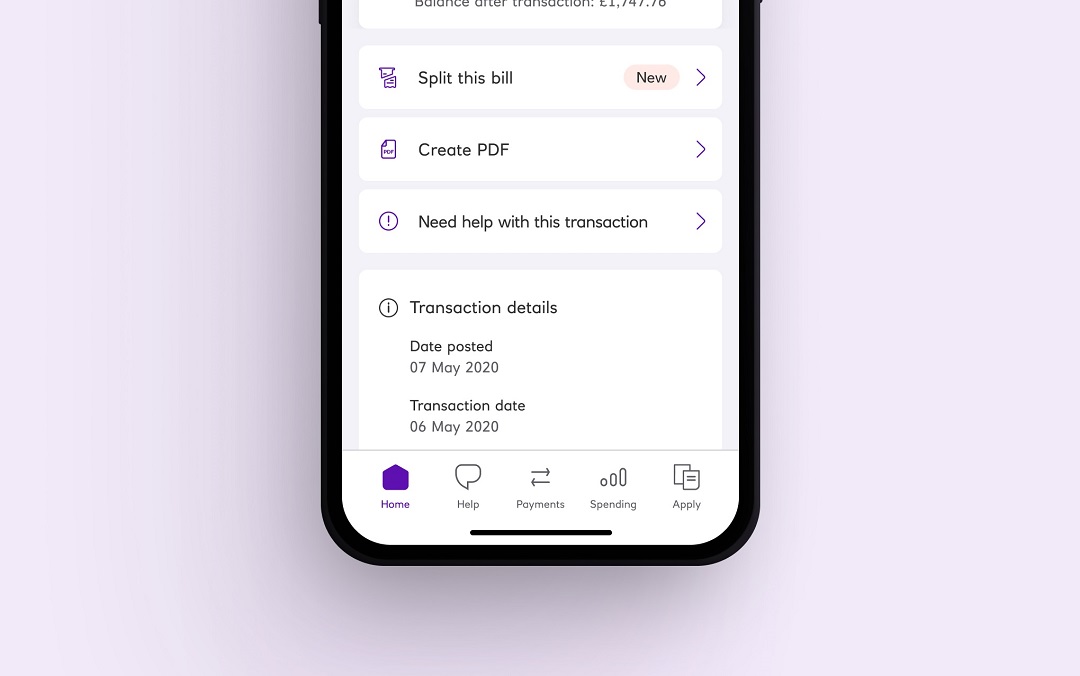

Split bills easily

Pay Me lets friends pay you back without the faff of sharing bank details. And Split Bill is an easy way to share the cost of meals, even when your mates leave their wallet at home. Eligibility criteria and limits apply.

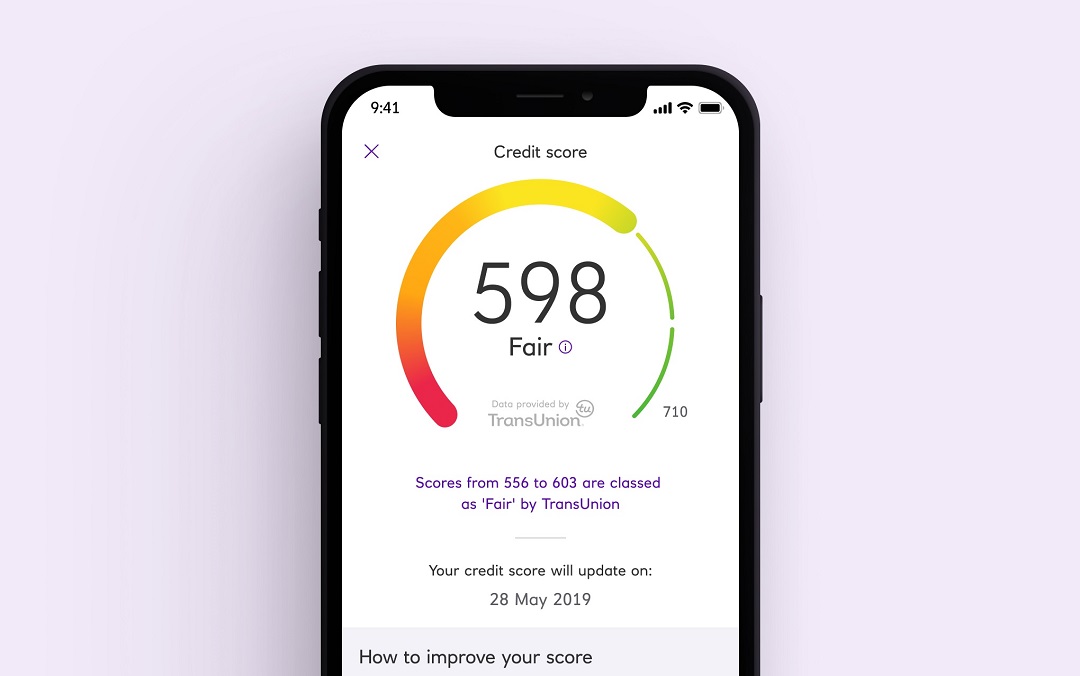

Check your credit score for free

Our personalised tips could help you improve your credit score and kick-start a brighter financial future. The higher your score, the more likely you are to get better deals and interest rates.

Credit score available once opted in through the app, to customers aged 18+, with a UK address and data is provided by TransUnion. Mobile app available to customers with compatible iOS and Android devices and a UK or international mobile number in specific countries.

Save your change with round ups

Save the spare change from your debit card spends straight to your savings account with NatWest Round Ups. It’s saving, made simple. Eligibility criteria and conditions apply.

Split bills with the Housemate app

Housemate is our free bill-splitting app for renters. Split bills and pay each other back easily. Your flatmates don’t even need to bank with us to use it.

To get started just download Housemate by Natwest.

Available to anyone over 17 as long you live in the UK, have a UK bank account (that allows access) and be registered for online banking. You’ll also need a compatible smartphone.

Ways to pay

Unlock the benefits of using your NatWest card

There are many secure and convenient ways to pay with your NatWest card.

Learn more about:

- Apple Pay

- Google Pay

- Contactless payments

Criteria apply.

Preparing for life after university

We have some top tips for you

After graduation you may need to think about paying off your student loan, getting your first job or perhaps plan to travel.

Taking a step back and looking at your finances could really help you to feel in control and stay on top of your spending.

Important documents to read

We do our best to ensure everyone is aware of their account terms and conditions, please take some time to review, print and/or save a copy of these.